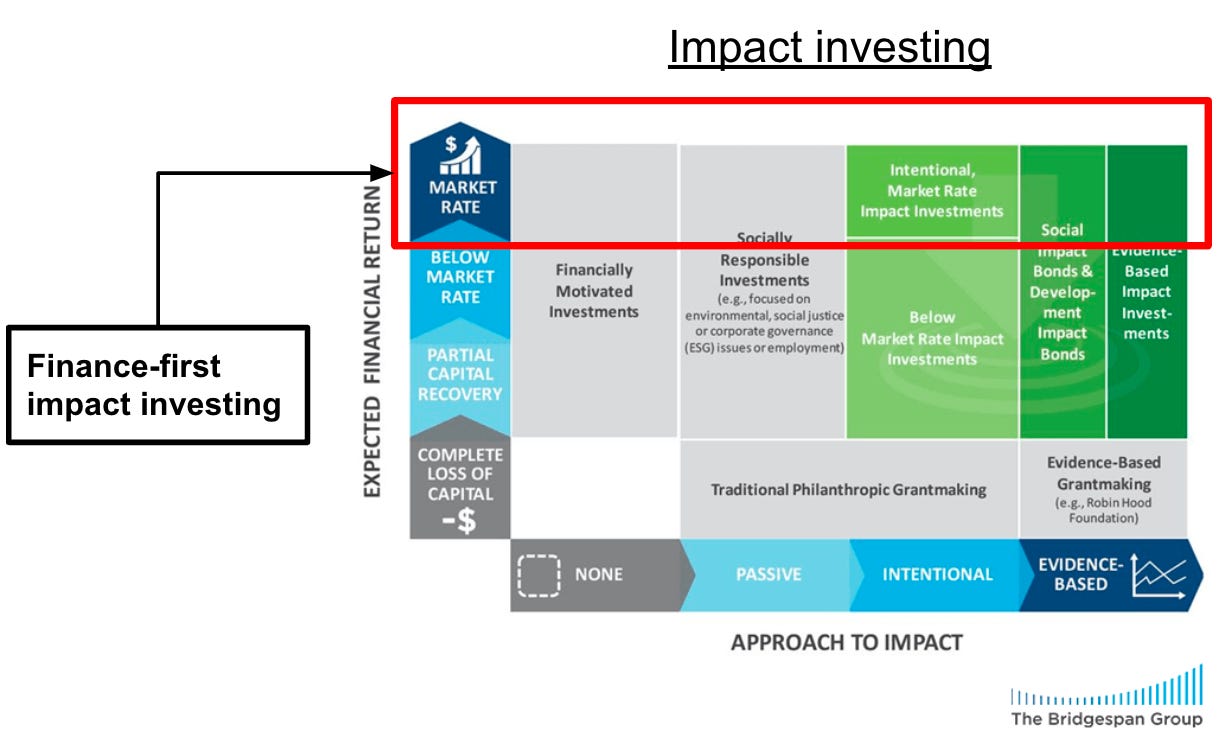

I believe in finance-first impact investing.

The ‘finance-first’ part means I expect an above market-rate financial return (over 10 years); the ‘impact’ part means I’m investing in startups that are sustainable-by-design.

When making impact investments, I’m applying the exact same venture capital principles that standard investors use, the only difference being I purposefully narrow my search to early-stage companies that are, what I refer to as, environmentally sustainable-by-design.

What is sustainable-by-design?

*Many climate and ocean tech startups are sustainable-by-design. As the business scales, so does its impact. Making money and improving the state of the environment are directly correlated.

Sustainable-by-design means it would be impossible for a company to hit a billion dollar valuation and not also have a significant positive environmental impact.

*(I say ‘many climate and ocean-tech startups are sustainable-by-design’ and not all because some companies are not environmentally related but make a claim such as “10% of proceeds go towards ABC restoration project in XYZ obscure, poor country”. Those are fine when the impact actually happens and is verifiable, but I don’t qualify the technology of the company as inherently “sustainable-by-design”).

An example of sustainable-by-design would be any renewable energy startup. Let’s use SolarSquare Energy, who are bringing solar modules to rooftops in India, as an example. (They’ve just raised a successful $13M Series A)

As the company installs more solar panels, it makes more money. It also has a growing positive environmental impact:

More solar panels → more renewably-produced electricity → less of a need for greenhouse gas emitting fossil fuel–produced electricity.

Investing in energy companies is a pain in the butt (we’ll examine those another time, the energy companies, that is 🍑🧐).

So, let’s take a different example:

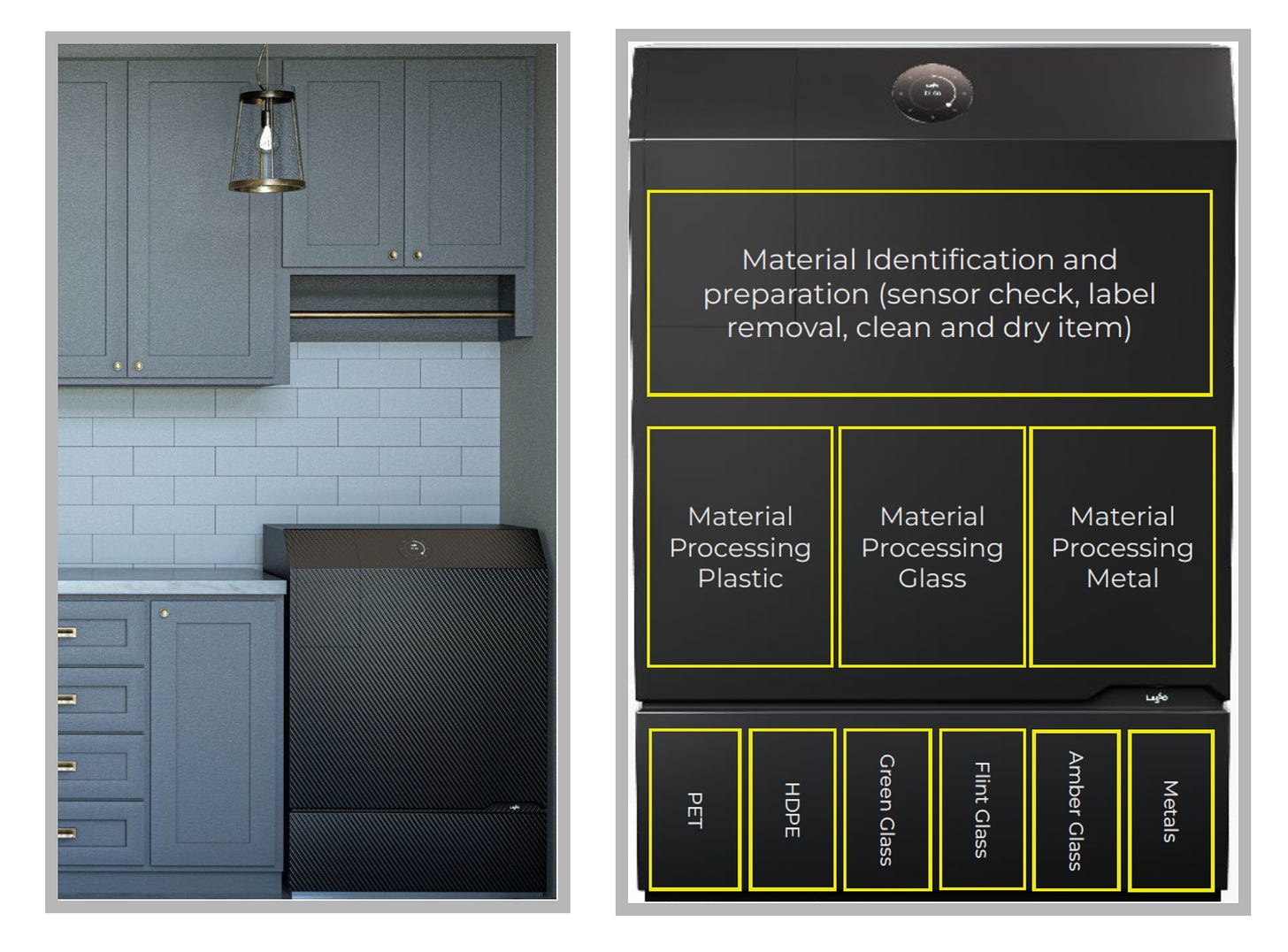

Lasso Loop is sustainable-by-design. The company is completely redesigning the recycling value-chain by creating an at-home waste cleaning, sorting, and crushing solution. It’s an appliance the size of a small suitcase that replaces your trash can in your kitchen. Throw in your garbage and let the machine take it from there.

Lasso is especially cool because the device increases the value of your trash, incentivizing recyclers to ACTUALLY recycle the materials and make a profit. As this company sells more and more appliances, less and less waste hits landfills (it goes clean to recyclers), making it satisfy our requirements for sustainable-by-design.

When I picture a clean, one-with-nature, AI-makes-all-our-lives-easier-and-doesn’t-kill-us-all, utopian future, I imagine this device in every home.

It’s a moonshot, but if you’re looking for abnormal returns, you better be making abnormal investments.

All startups strive to create value, but not all startups create value with regards to improving the state of the environment.

Sustainable-by-design startups are not easy to start because you have to figure out a way to make money solving an environmental problem. This is difficult because startups make money by solving a problem for people.

You often can’t just ‘solve the environmental problem,’ you must also create an added layer of value for people.

Example: Ocean Bottle, which funds ocean plastic removal to use as raw material in creating a very handy, insulating, dishwasher-safe water bottle (they’re great, trust me, we’ve invested, and I also have 3).

Nobody with a brain expects investment returns from just collecting plastic pollution.

But, they might expect returns if you can turn that plastic into a high-margin product.

In summary, as an impact investor seeking to beat the market and prove to the world that doing good and making money aren’t mutually exclusive, but instead go hand in hand, I look for sustainable-by-design startups. If their technology net reduces CO2, eliminates waste, and removes plastic, then as the cash flow comes in, so does the positive environmental impact, making our LPs proud 🥲.