ReFi - The New Eco-Economic Frontier

How regenerative finance is creating a better financial system with our planet in mind

ReFi can be described as the combination of ecology, regeneration, and finance, but what does this really mean and what is possible?

A new economic paradigm is here and it’s focused on improving the resources that are most critical to our well-being - our planet and our people.

To understand this new world of ReFi, let’s start with understanding what it means to regenerate and then how that applies to finance.

What does it mean to regenerate?

To make something regenerative means to improve or create more of something, like an environmental ecosystem or any capital asset - that is, any asset that provides goods/services that benefit our well-being.

A system that is regenerative aims to continually create more capital assets.

This is in stark contrast with an extractive or degenerative system which depletes capital assets.

An example is regenerative farming, a practice that is implemented when growing crops that aims to improve soil health and biodiversity. This creates regenerative effects because the act of producing capital assets (crops) improves the capital assets (soil) used to create them, which could also lead to increased crop yield.

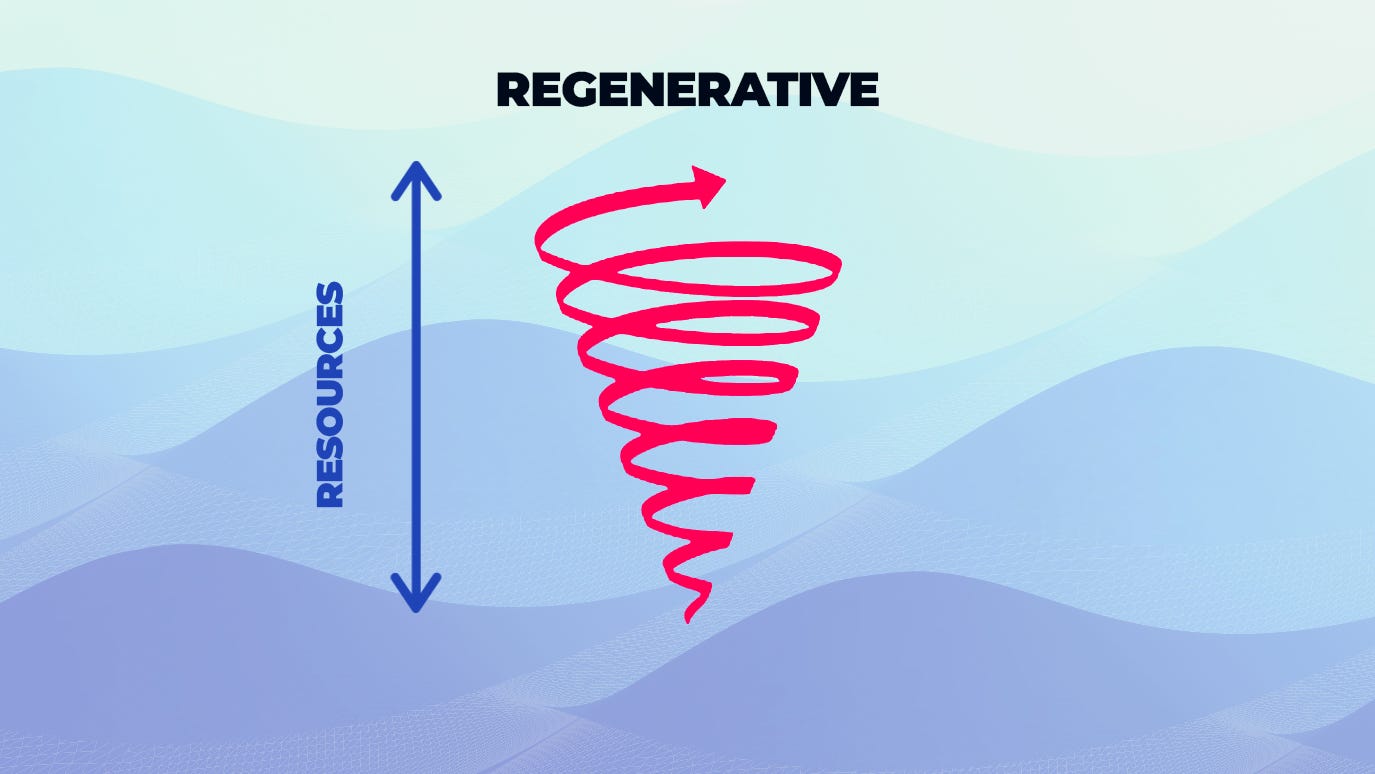

You can see how this could become a virtuous cycle of regeneration - a flywheel effect some might say.

What is regenerative economics?

Regenerative economics applies the concept of regeneration to economic systems where the goal of a given economic system is to regenerate capital assets.

The problem with the standard capitalist economic framework is that it has not accounted for the capital assets that have let us create all other capital assets - the sun and the earth. Regenerative economics recognizes and gives economic value to these natural assets.

Regenerative economists have theorized that since these original capital assets have traditionally not been recognized in economic systems, it has led to an extractive economy where we have unsustainable economic growth that ultimately harms our well-being.

Think of it this way. During the industrial revolution, we had tons of economic growth, but because of the way that growth was being fueled (i.e., burning lots of coal), it led to a ton of pollution and practices that ultimately made the well-being of people across the world suffer.

Regenerative systems and positive-sum outcomes

When we talk about regeneration, whether in the context of economics, finance, or in our natural environment, we’re speaking from a systems point of view. We’re trying to figure out how to build regenerative systems (more on this below).

The goal of these systems is to create positive-sum outcomes. Positive-sum means that the sum of actions, interventions, or processes within a system creates outcomes that meet the intended goals for all stakeholders in a given system - or if you prefer fancy economic words, it creates positive externalities.

In a world where much of our culture revolves around profit maximization at all costs, we often don’t account for the negative effects the systems we create based on this line of thinking may have on our resources, or the potential negative externalities these systems may create.

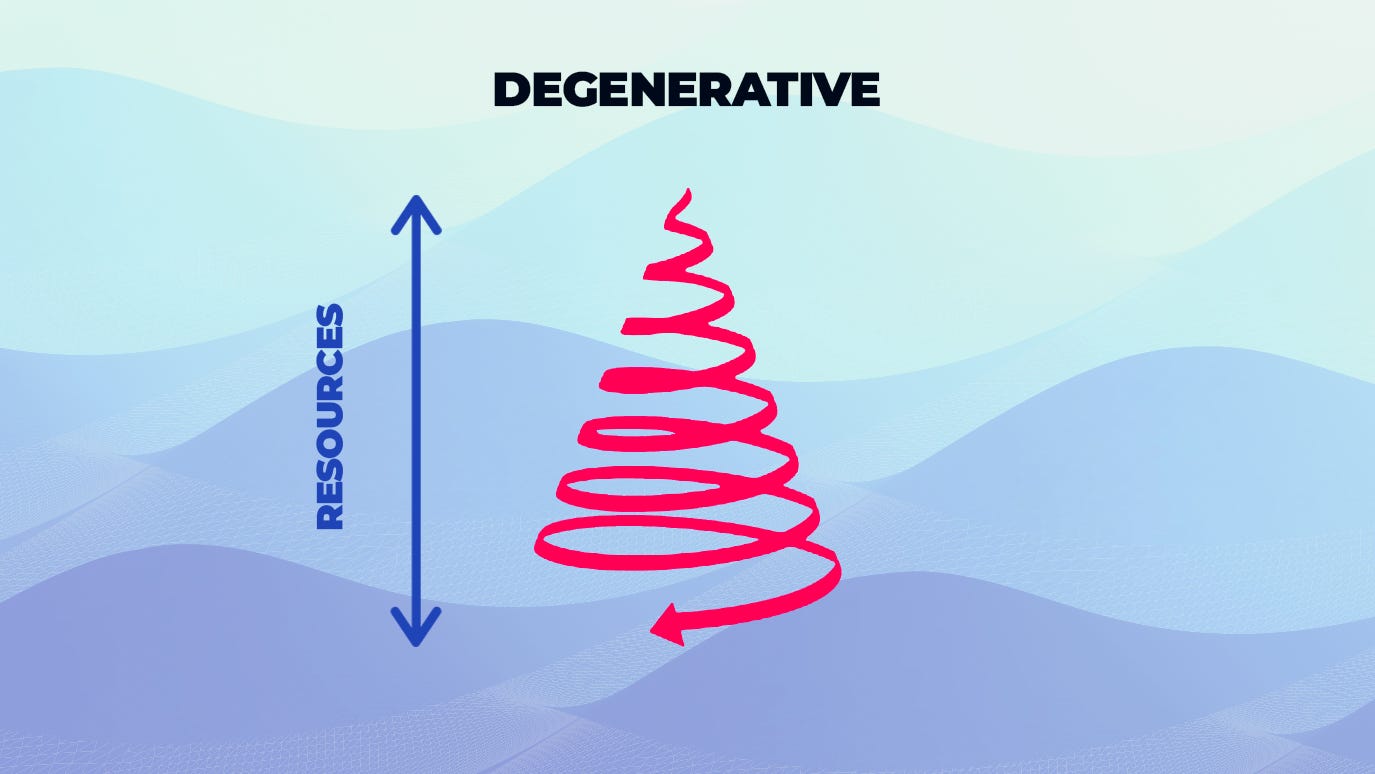

A degenerative system decreases resources in an unsustainable way over time.

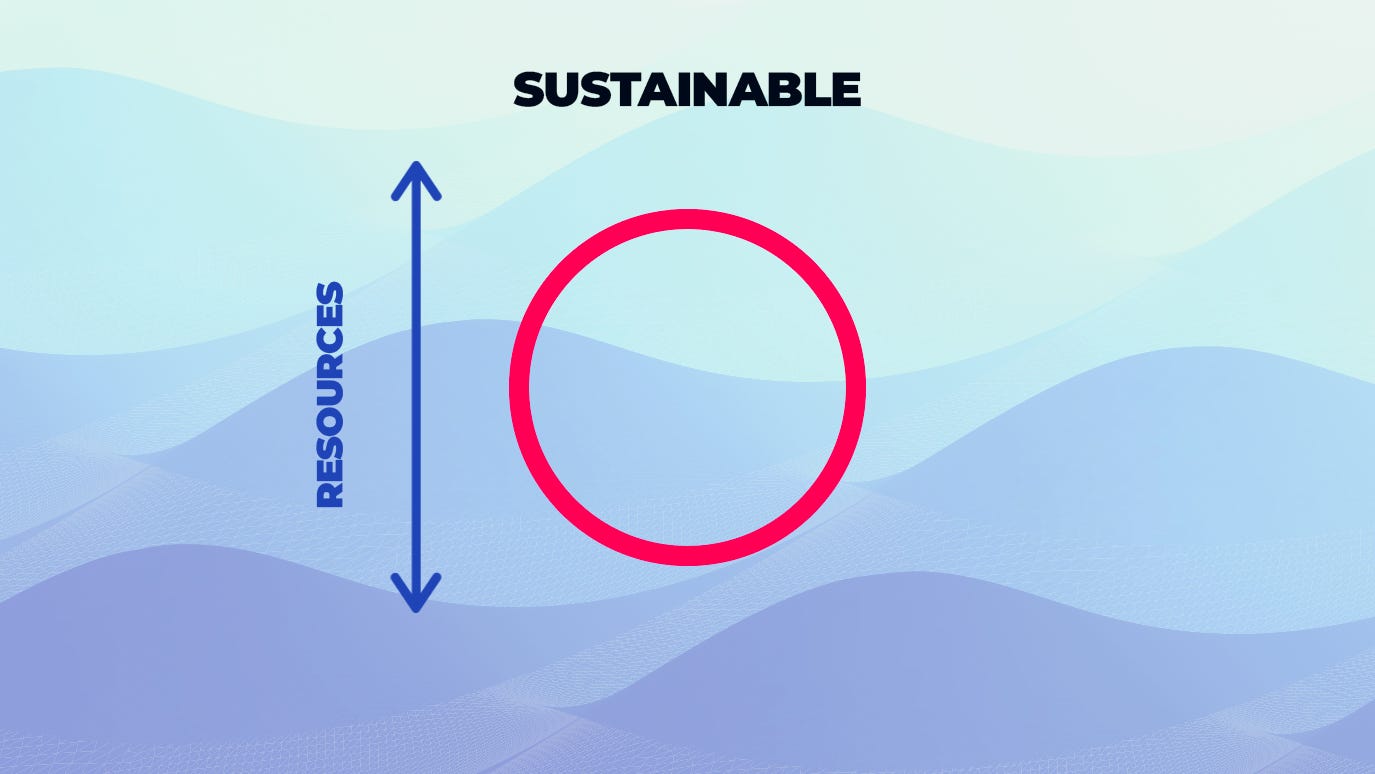

A sustainable system has a neutral impact on resources over time, replenishing them and thus maintaining the stability of the system.

A regenerative system has a positive impact on resources over time, going further than just replenishment and increasing and/or improving them as it runs.

What is regenerative finance?

Regenerative Finance is a framework that explores how capital, financial practices, and economics can be used for purposes that create regeneration.

The underlying philosophy of regenerative finance is centered around how we can create systems that focus not only on profit-maximization, but also take into account other important variables, recognizing that we do not live in a world with unlimited resources.

ReFi is essentially able to put regenerative economics into action. Because implementations of ReFi have been able to put a price on natural assets, like for example carbon, we can now build financial systems around this that attempt to preserve and regenerate resources like trees.

In the case of carbon credits, the theory is that since forests can be monetized through these credits, people will be more inclined to preserve the forests and even plant new forests rather than cutting them down because of the economic incentive to keep them.

Until recently with the explosion of Web3 technologies, this topic was very nascent and the term “ReFi” did not really exist. There has been a recent boom of startups that are looking at how to embed these regenerative economic principles into products, business models, and even money itself.

The reason Web3 in particular was the catalyst for this acceleration of the market is because blockchains and related technologies are the perfect infrastructure for being able to build these systems on.

How can ReFi benefit the planet and society?

Startups like Toucan and Regen Network are working on how to build a regenerative economy by utilizing blockchain technology to better integrate natural assets like carbon into our financial systems.

This creates the foundations for people to create products leveraging tokenized (or, in other words, financialized) carbon credits that link directly to the removal or sequestration of carbon (a good thing for the planet).

The idea is that if we can financialize these natural resources and embed them into products, business models, and other systems, then we can:

Finance and incentivize impactful practices, like the sequestration of carbon or the increase in biodiversity of an ecosystem

Create new incentive structures that lead to beneficial outcomes for society

While ReFi has become more of a movement led by Web3 pioneers, it is our belief that ReFi exists as a concept outside blockchain technology as well. Blockchain is a tool that can be used to build ReFi use-cases, but ReFi itself is technology agnostic.